The federal Tax Cuts and Jobs Act of 2017 was signed into law on Dec. 22, 2017. The Opportunity Zone program was included in that act, which was designed to provide tax incentives to investors who fund businesses in underserved communities. Investors can defer paying taxes on capital gains that are invested in distressed communities designated as Opportunity Zones by the governor of each state.

Grays Harbor has three “Opportunity Zone” census tracts:

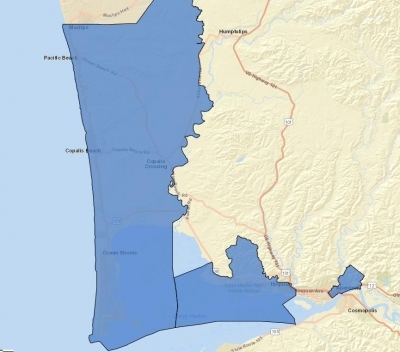

Pacific Coast – Ocean Shores to Moclips (Census Tract: 53027000200)

Hoquiam

Aberdeen

Useful Resources

- Presentation slides Grays Harbor – OZ Event 4.11.19

- Opportunity Zones Overview – WA Dept of Commerce

- Opportunity Zone Investments – OZI

If you have questions, have an OZ project you’d like to discuss or promote, or are looking to invest in a Grays Harbor Opportunity Zone, please contact us.