The first month of the 2021 Washington Legislative Session has wrapped and GGHI has provided a brief snapshot of information below. As always, things move at a quick pace during session, so we always recommend checking out the latest bill information by visiting the Bill Information page on the Washington State Legislature website.

GGHI Members are encouraged to join us on our weekly Legislative Committee call. Members can register for a weekly call on our Events Calendar. Be sure to register before 3pm so that you receive the agenda and meeting materials on time.

SB 5061 – Unemployment Insurance

In an effort to stave off skyrocketing unemployment taxes facing employers in 2021 addressing UI became one of the primary priorities of the legislative session. SB 5061 has passed the Senate and the House, and its next step is the Governor’s desk. SB 5061 is not considered a “fix” to the problem and is characterized as a starting point for UI relief as there is broad discussion of the issue receiving additional attention later in session.

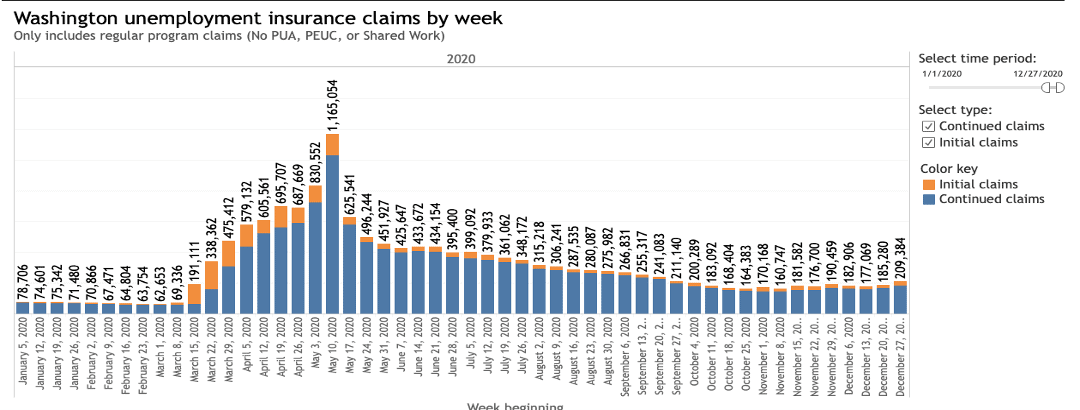

Below is graph illustrating state-wide insurance claims (initial and continued) per week in 2020. More data related to employment and other economic recovery metrics can be found at the Economic Recovery Dashboard hosted by the Washington State Department of Commerce.

HB 1368 – Responding to the COVID-19 pandemic through state actions supported by federal funding.

Passed by the House and scheduled for Senate Ways and Means public hearing on Tuesday February 2ndand an executive session on Thursday, February 4th this bill sets the framework for how federal relief funds will be administrated and used at the state level.

SB 5114/HB 1321 – Concerning safely reopening Washington.

SB 5114 was heard in committee on January 20th with a record setting number of individuals and associations prepared to testify. The bill was subsequently called to the Senate Floor for a vote and failed to pass. This action took place the day before new standards to the state’s Roadmap to Recovery plan were announced and subsequently moved some counties into Phase 2 of the plan. There remains a great deal of interest and effort to allow the entire state to reopen safely as well as concern about the regional approach to opening standards. Stay tuned for more discussions on this topic. You can watch the floor vote here.

Scheduled for a public hearing on Tuesday, 2/2 (4:00 pm) in Senate Ways and Means and Executive Session on Thursday, 2/4 this bill would provide tax relief to businesses that received economic assistance grants related to COVID-19 impact (“official proclamation of a state of emergency by the President or by the Governor”).

An overview of the distribution on the Department of Commerce’s Working Washington Grants (Rounds 2 & 3) can be viewed here. This data is only for those dollars that come through the Department of Commerce and does not include any small business grants provided by local government.

Bills to Watch

SHB 1015 – Creating equitable access to credit.

HB 1170 – Building economic strength through manufacturing.

HB 1189/SB 5211 – Authorizing tax increment financing for local governments

HB 1076 – Allowing whistleblowers to bring actions on behalf of the state for violations of workplace protections.

SB 5034 – An act relating to nonprofit corporations.

SB 5368 – Encouraging rural economic development.

HB 1333 – Providing an extension to the local sales and use tax for public facilities in rural counties.

HB 1084 – Reducing statewide greenhouse gas emissions by achieving greater decarbonization of residential and commercial buildings.

SB 5341 – Increasing permissible uses of existing local sales tax authority.