April 1st marked Major League Baseball’s Opening Day (can you find historic Olympic Stadium) and the start of the final month of the 2021 Legislative Session. It is a critical time in session as budget bills have passed out of each chamber and we are approaching the cutoff of passing bills from the opposite chamber. To learn more about each legislative chamber’s budget proposals click here. There are good summary documents and project lists when relevant.

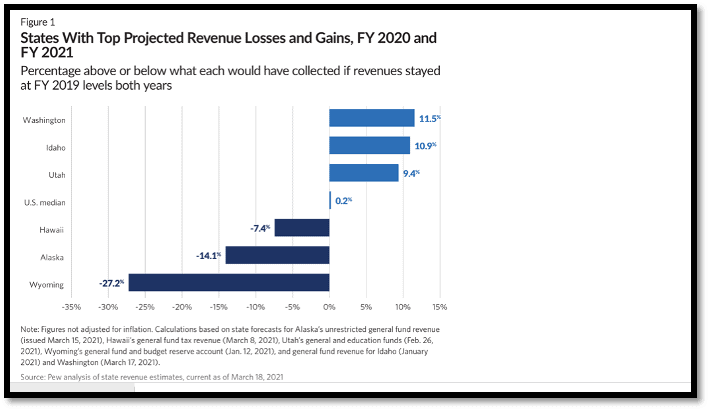

Much of the conversation in Olympia and beyond is circulating around the state revenue forecast and Washington’s projected revenue gains. It is no secret that Washington is performing well and now the debate centers around the need to raise additional state revenue given the projected performance and the continuing uncertainty businesses face as they navigate the short and long-term impacts of the pandemic related economic downturn.

A recent report by the Pew Trust recognized Washington State with the highest revenue gains in the country. Click here to learn more about this report and the research methodology.

Image courtesy of www.pewtrust.org

The release of the Transportation budget proposals from each chamber reflects a concern about “declining gas tax collections and higher transportation costs associated with the COVID-19 pandemic and other factors,” (Washington State Policy Center). To read Washington Policy Centers full coverage of the Transportation Budget click here. Additionally, with the passage of the American Rescue Plan Act (ARPA) there will be federal relief dollars to support our state’s transportation revenue shortfalls. Read more about how the Senate Transportation Bill utilizes those funds at the Washington Wire website.

Bills of Note

HB 1170 – Building economic strength through manufacturing.

This bill establishes the goal to double the state’s manufacturing employment base in 10 years and engages the Washington State Department of Commerce to prepare a biennial report on the state of manufacturing in Washington as well as a statewide manufacturing council to advise and consult.

HB 1076 – Allowing whistleblowers to bring actions on behalf of the state for violations of workplace protections.

This bill allows a third party to file a complaint against an employer on the behalf of an employee. These laws are called “qui tam” laws and are seen in over half of the states in the country.

Bills to Watch

SHB 1015 – Creating equitable access to credit.

HB 1333 – Providing an extension to the local sales and use tax for public facilities in rural counties.

HB 1189/SB 5211 – Authorizing tax increment financing for local governments. Passed both Chambers.

SB 5368 – Encouraging rural economic development.

SB 5341 – Increasing permissible uses of existing local sales tax authority.

As always, things move at a quick pace during session, so we always recommend checking out the latest bill information by visiting the Bill Information page on the Washington State Legislature website.

GGHI Members are encouraged to join us on our weekly Legislative Committee call. Members can register for a weekly call on our Events Calendar. Be sure to register before 3pm so that you receive the agenda and meeting materials on time.