The top of March represents roughly the halfway point of the 2021 Washington Legislative Session. We are providing an overview of current happenings. As always, things move at a quick pace during session, so we always recommend checking out the latest bill information by visiting the Bill Information page on the Washington State Legislature website.

GGHI Members are encouraged to join us on our weekly Legislative Committee call. Members can register for a weekly call on our Events Calendar. Be sure to register before 3pm so that you receive the agenda and meeting materials on time.

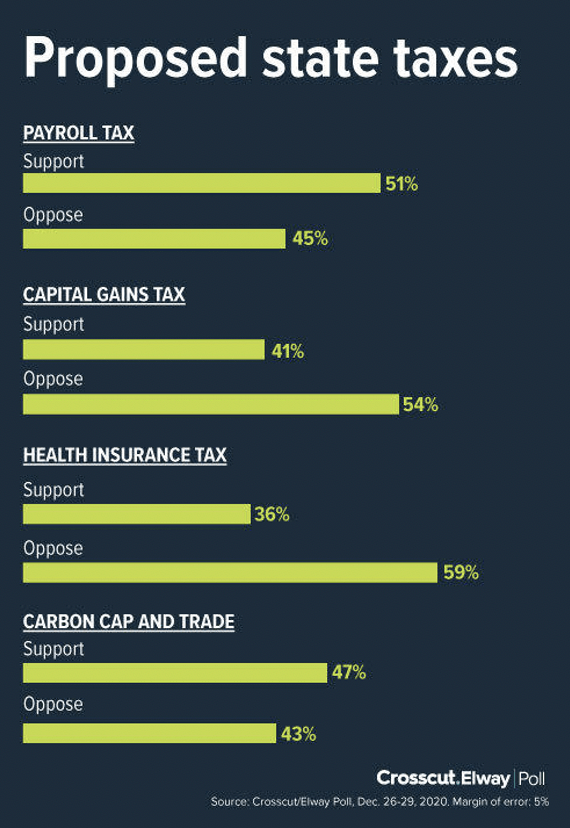

Surely one of the most talked about bills of the session this bill is framed as a capital gains tax. SB 5096 isn’t alone in Olympia and AWB has provided a comparison guide of the three active bills. Public sentiment is polling heavily against a capital gains tax which many feel will eliminate one of Washington’s key competitive advantages in recruiting and retaining business. To learn more about the polling and public sentiment.

HB 1368 – Responding to the COVID-19 pandemic through state actions supported by federal  funding.

funding.

We referenced this bill in last month’s wrap up and since then it has been signed by the Governor. This bill will release economic relief to specified industries and businesses. Look for small business relief grant applications to open at the end of March or early April.

HB 1095 – Exempting businesses from paying taxes on emergency assistance grants from state or federal government.

This bill has also passed both chambers and was passed into law on February 19,2021. This bill ensures that grants received by businesses during the pandemic would not be subject to state B&O Tax.

HB 1076 – Allowing whistleblowers to bring actions on behalf of the state for violations of workplace protections.

This bill allows a third party to file a complaint against an employer on the behalf of an employee. These laws are called “qui tam” laws and are seen in over half of the states in the country.

HB 1084 – Reducing statewide greenhouse gas emissions by achieving greater decarbonization of residential and commercial buildings.

This bill was scheduled for Executive Session in the House Appropriations Committee, but the committee took no action. While no bill is “officially dead” until session is over the bill has not made the cutoff date to move any farther in the legislative process.

SB 5341 – Increasing permissible uses of existing local sales tax authority.

Sponsored by Legislative District #19 Senator Jeff Wilson this bill provides a fix in how rural first responder agencies (emergency medical) fund training for their personnel from the public safety sales tax. Grays Harbor County Commissioner Vicki Raines provided testimony in support.

Bills to Watch

SHB 1015 – Creating equitable access to credit.

HB 1333 – Providing an extension to the local sales and use tax for public facilities in rural counties.

HB 1170 – Building economic strength through manufacturing.

HB 1189/SB 5211 – Authorizing tax increment financing for local governments

SB 5034 – An act relating to nonprofit corporations.

SB 5368 – Encouraging rural economic development.

SB 5341 – Increasing permissible uses of existing local sales tax authority.

funding.

funding.